Let’s discuss the question: how to make a bank drop. We summarize all relevant answers in section Q&A of website Achievetampabay.org in category: Blog Finance. See more related questions in the comments below.

What’s bank drop?

“Bank drop” is a term used for a bank account that is controlled by a fraudster to transfer stolen funds into. Fraudsters use fake or stolen personal information to create bank drops.

Can my bank drop me?

You may not think it could happen to you. A bank generally can close your account at any time and for any reason—and sometimes without notifying you in advance. Reasons a bank may shut down your account include using your account very little or not at all, or bouncing too many checks.

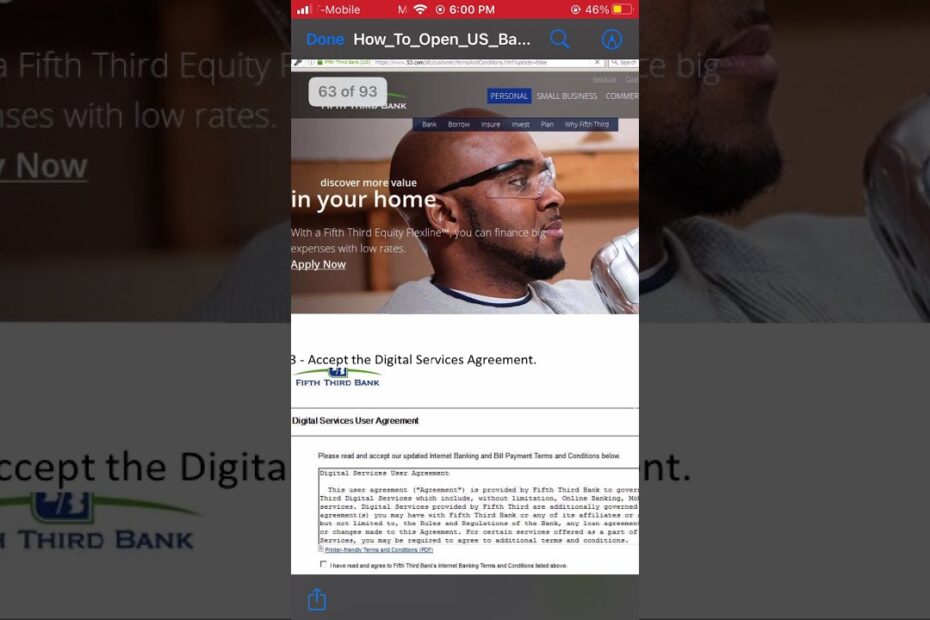

How to open bank drop method

Images related to the topicHow to open bank drop method

What can I use instead of a bank?

- Credit unions. Credit unions are different to banks in that they’re run for the benefit of customers, rather than to generate profits for shareholders. …

- Wise. …

- Online banks & neobanks. …

- Certificates of deposit. …

- Money market mutual funds.

How do I cash out a drop?

Most rewards programs are free to use (as is Drop, by the way), and you can simply transfer the funds to a PayPal account or cash out using gift cards when you want to redeem your rewards points. Drop requires a credit card link because the way you earn points is by shopping.

What is money mule transaction?

Money Mule is a term used to describe innocent victims who are duped by fraudsters into laundering stolen/ illegal money via their bank account(s). Money mules are recruited, sometimes unwittingly, by criminals to transfer illegally obtained money between different bank accounts.

What is electronic draft?

Electronic draft capture (EDC) is a system that captures transaction data for processing and storage at the merchant location. It may also be referred to as remote deposit capture.

Can a bank refuse to give you your money?

Yes. A bank must send you an adverse action notice (sometimes referred to as a credit denial notice) if it takes an action that negatively affects a loan that you already have.

Why would a bank kick you out?

Your financial institution might close your account if you have excessive overdraft fees or you’ve had a continuous negative balance; if you frequently have more transactions in your savings account than are allowed per statement cycle; or if your paper checks are lost or stolen, for example.

Can you sue a bank for closing your account?

Assuming you’ve left out NO important facts here like WHY they closed the account and IF you owed them money, then certainly, you can sue them and you may even win.

How can I protect my money?

- Check your accounts DAILY. …

- Know your protections. …

- Turn paper statements on. …

- Choose a bank with good customer service. …

- Never share your banking information with anyone. …

- Use strong passwords & two-factor authentication. …

- Don’t access your financial accounts from just anywhere.

Where do you put large sums of money?

- High-yield savings account. …

- Certificate of deposit (CD) …

- Money market account. …

- Checking account. …

- Treasury bills. …

- Short-term bonds. …

- Riskier options: Stocks, real estate and gold. …

- Use a financial planner to help you decide.

Should I keep my money in the bank or at home?

It’s far better to keep your funds tucked away in an Federal Deposit Insurance Corporation-insured bank or credit union where it will earn interest and have the full protection of the FDIC. 2. You may not be protected if it is stolen or destroyed in the event of a robbery or fire.

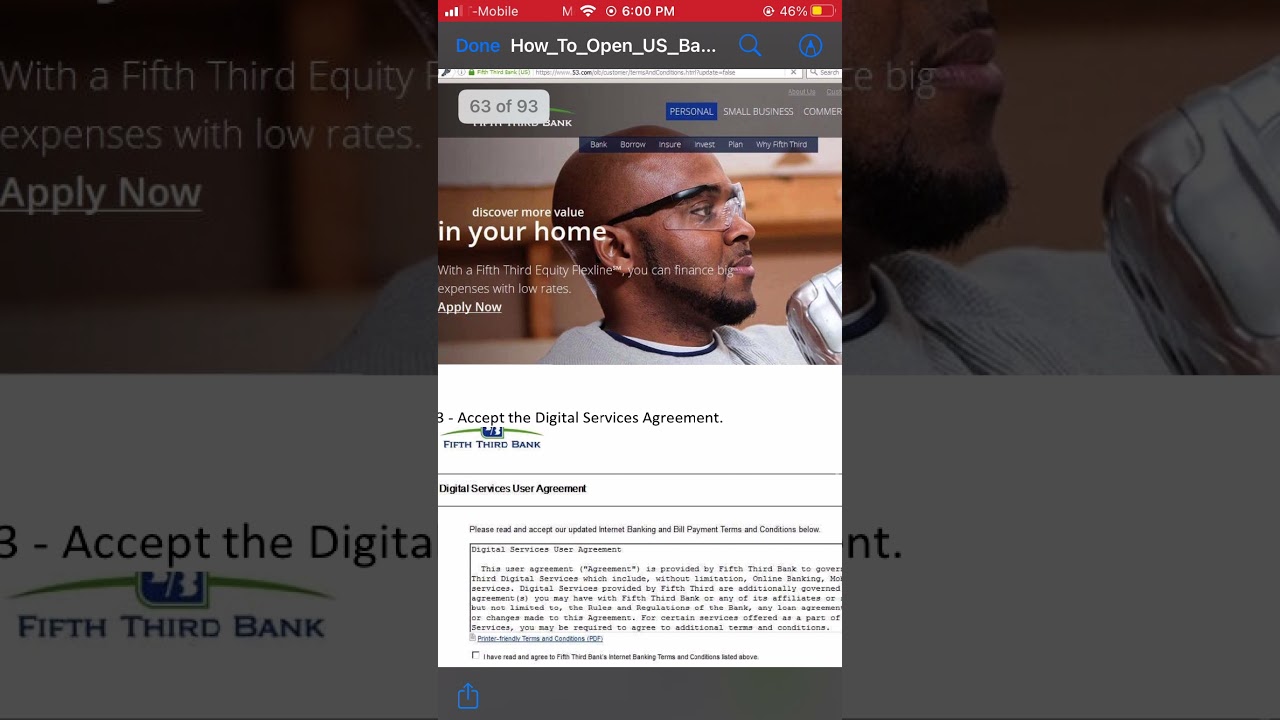

How to create a drop bank account

Images related to the topicHow to create a drop bank account

Is Drop safe to use?

Is the Drop app safe to use? If you’re uncomfortable with sharing your bank logins, you shouldn’t use Drop. And during its initial testing phase in the U.S., some users reported numerous issues with Drop, including purchases not posting or not being able to redeem points.

How safe is the drop app?

Drop uses bank-level 256-bit encryption to secure your account and personal information. This is similar to the security used by other financial technology companies including Acorns, Robinhood, and Mint. Drop does not see your bank account balances and can only track your transactions using the app.

What happens when you cash out?

When someone sends you money on the Cash App, it stays in the app but a user can ‘Cash out’ the money from Square Cash Card which can be used it as a debit card and spend your balance anywhere that accepts Visa.

What is CDD in banking?

CUSTOMER DUE DILIGENCE / KYC TRAINING & QUALIFICATIONS

KYC or Customer Due Diligence (CDD) collates information about your customers to assess the extent of any risk they pose to the firm. This doesn’t simply mean taking a copy of a passport to prove identity.

Can you go to jail for being a money mule?

Acting as a money mule is illegal and punishable, even if you aren’t aware you’re committing a crime. If you are a money mule, you could be prosecuted and incarcerated as part of a criminal money laundering conspiracy.

Which are the 3 stages of money laundering?

This process involves stages of money laundering: Placement, Layering, and Integration.

How do I send a bank draft?

- Check your bank account balance before asking for a bank draft. …

- Visit your bank and ask to create a bank draft. …

- Mail the bank draft to the recipient, if you didn’t use an online method.

Can a bank draft be fake?

Bank drafts are not a guaranteed proof of payment as fraudsters can create them and pass them off as genuine, writes Ellen Roseman.

How much do bank drafts cost?

Bank drafts can be used to make a payment to a third party, both in Canada and abroad1 and are available for a fee of $8.50 each. Some banking packages include a number of free bank drafts per year, so be sure to review your account features prior to requesting one.

How do I hide large amounts of cash?

Ways to Hide Money: Secret Cash Stash

Keep some emergency cash rolled up in a clean, empty sunblock tube. Tuck it in a drawer or medicine cabinet where you can easily grab it when you need it. Don’t forget about the garage!

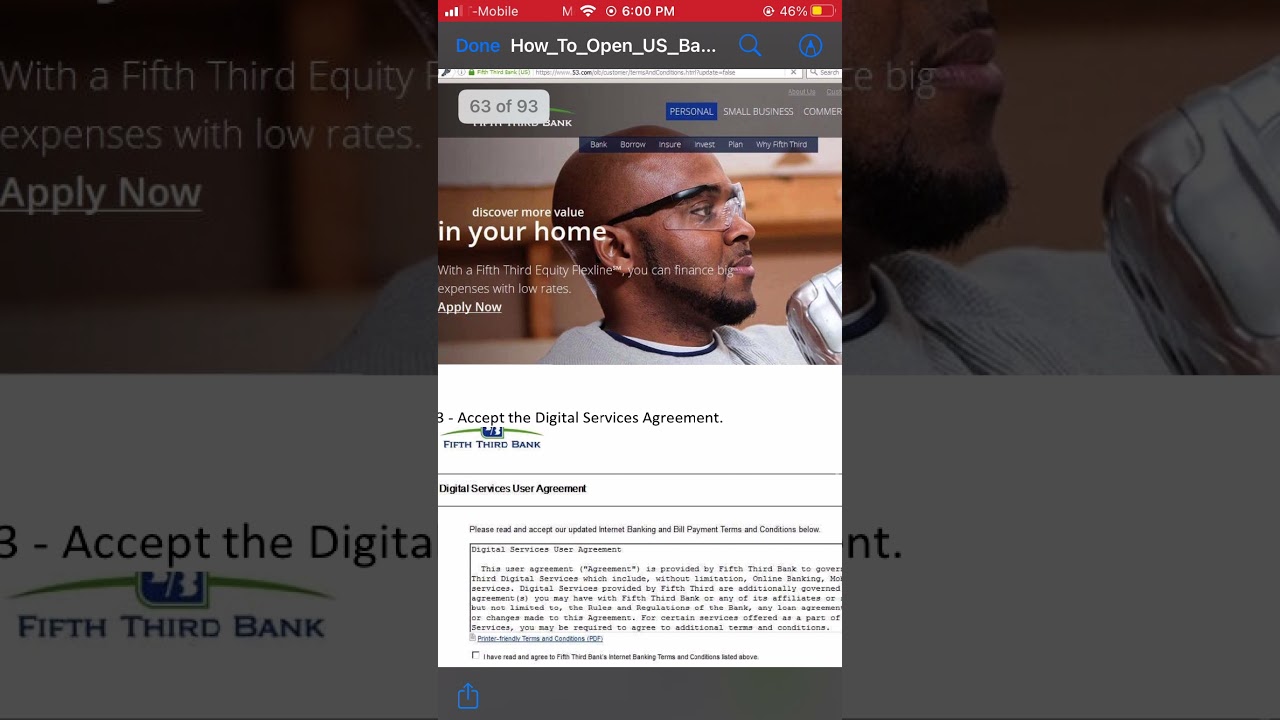

EASIEST WAY TO MAKE A BANK DROP TO CASHOUT

Images related to the topicEASIEST WAY TO MAKE A BANK DROP TO CASHOUT

Can I withdraw $6000 from my bank?

Can I Withdraw $6000 from My Bank? Yes, you can withdraw $6000 from your bank as long as you have $6000 in your bank account.

Why do banks report withdrawals over $10000?

When you go to deposit more than $10,000 at a time, your bank, credit union or financial provider is required to fill out a currency transaction report to the Internal Revenue Service. It’s mainly for security purposes.

Related searches

- bank drop method 2022

- bank drop method

- fifth third bank

- aged bank drop

- bank drops reddit

- how to open a bank drop

- how can you bank without a bank

- how is money stored in a bank

- what is a bank drop account

- check dropping method

- bank check drop method

- boa cashout method

- bank drop method 2020

- how to make a bank deposit by phone

- td bank

Information related to the topic how to make a bank drop

Here are the search results of the thread how to make a bank drop from Bing. You can read more if you want.

You have just come across an article on the topic how to make a bank drop. If you found this article useful, please share it. Thank you very much.