Net Worth Update – May 2021: Welcome to our Financial Independence Net Worth Update 2021. In this financial freedom update, we will be sharing our May 2021 Net Worth Update.

We will discuss how to calculate the net worth update 2021, what are our assets and liabilities to achieve financial independence. Here’s the formula to calculate your Net Worth Update:

Net Worth = Assets – Liabilities

Tracking the Net Worth Update allows us to have a better picture of our journey to financial independence. In doing that, we can ensure the journey to financial freedom is getting closer.

If you’re new to this channel, we are a Canadian couple in our mid 40’s to achieve financial independence in 2028. Our journey to FIRE started in 2019, with 60,000 dollars in debt. We are now getting closer to become financially independent. The numbers presented in this video are real and represent our financial situation.

▸ TIMESTAMPS

00:00 NET WORTH UPDATE MAY 2021 – FINANCIAL INDEPENDENCE

00:32 FIRE We Go: A Canadian couple’s journey to Financial Independence

00:53 How our Financial Independence Journey started?

01:18: Financial Independence Investments – We invest in dividend stocks, ETFs, and real estate

01:34 What is Net Worth?

01:52 What is the Net Worth Formula?

01:47 Net Worth Update 2021 Playlist

02:16 Net Worth Update – Journey to Financial Freedom – Our Assets breakdown

04:21 Net Worth Update –Total Assets for our Financial Independence

04:33 Net Worth Update – Journey to Financial Freedom – Our Liabilities breakdown

06:00 Net Worth Update –Total Liabilities for our Financial Independence

06:09 Financial Freedom – Net Worth Update 2021 – May

07:29 Net Worth Update 2021 – May Summary

08:22 Our strategy to achieve Financial Independence and retire early

11:05 When can we retire early? Our Why for FI (Financial Independence)

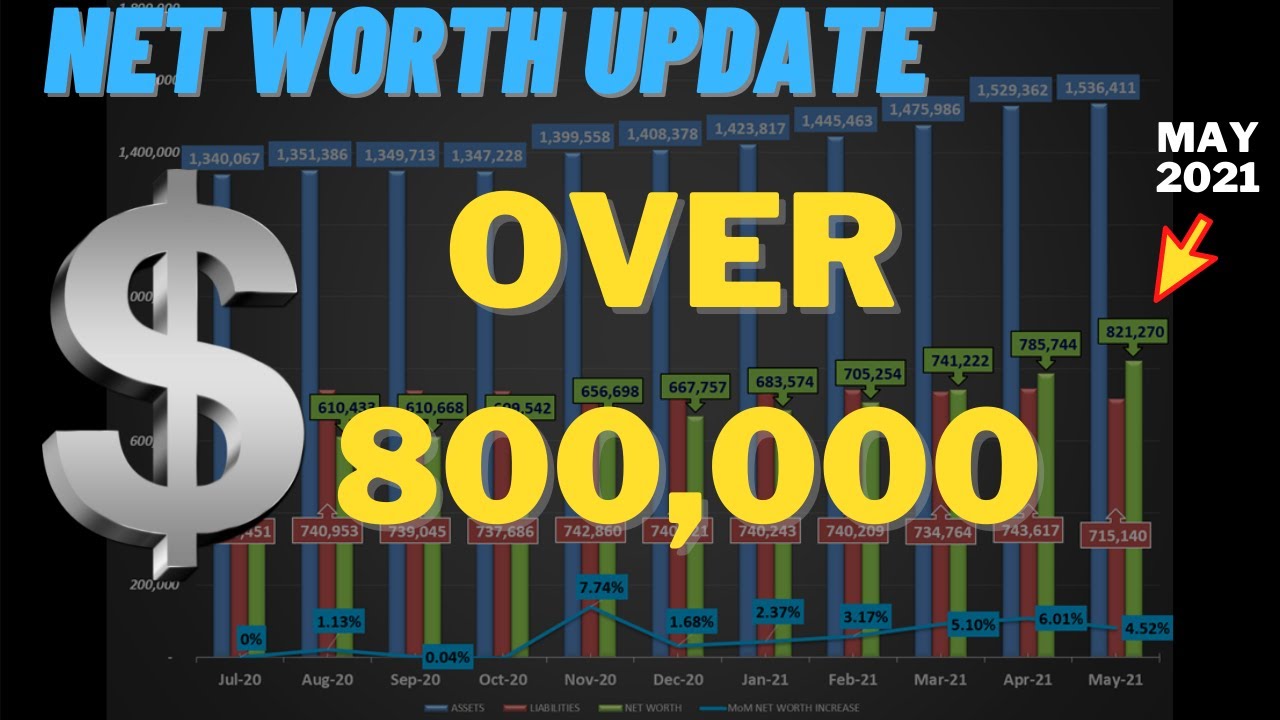

NET WORTH UPDATE 2021 – FINANCIAL JOURNEY SUMMARY

– Assets: $1,536,411

– Liabilities: $715,140

– May 2021 Net Worth Update: $715,140 (+ $35,526 over APR 2021)

▸ LINKS MENTIONED ON THIS VIDEO:

FIRE We Go!: A Canadian couple’s journey to Financial Independence:

WIKIPEDIA: .

Images related to the topic financial independence

NET WORTH UPDATE MAY 2021 – FINANCIAL INDEPENDENCE

Search related to the topic NET WORTH UPDATE MAY 2021 – FINANCIAL INDEPENDENCE

#NET #WORTH #UPDATE #FINANCIAL #INDEPENDENCE

NET WORTH UPDATE MAY 2021 – FINANCIAL INDEPENDENCE

financial independence

See all the latest ways to make money online: See more here

See all the latest ways to make money online: See more here

Really like your videos. Young people looking at marriage or lifelong relationships should take note. Do what these guys do. Be on the same team, work toward a unified goal, etc. Wish nothing but the best for you guys.

Hi fellow FIRE Torontonians. Found your channel a few months back and I've been keeping up with your updates. Looking forward to seeing your progress for June 2021.

This is awesome! Im sharing my journey as well!! Best of luck. I just turned 31, and plan to become financially independent by 40!

you both are doing amazing! Like #28

You both are so fun to watch! Really like your videos and following your FI journey. Congrats on the new net worth milestone 🙂 Hope you can finally make it to that beautiful condo in Brazil SOON!

Great job you two. I wouldn't worry about the lower dividends. It's the overall financial picture that's important. 🙂

May was a flat month for me. Stocks went up a bit, but alternative investments fell. It looks like June is shaping up to be a better month so far.

Well done guys! You're an inspiration.

You two have GREAT chemistry! It's fun to watch you in these videos (especially the bloopers). What I am not sure of that I am seeing many FI YouTubers do is pulling the equity out of their (your) house and invest in the stock market. That strategy works great in an up market. Would you do the same in a down market (assuming it will recover). Markets are up more than down so the odds are it will recover eventually. The question is do you still make the equity pull in a down market and invest it? Have you made plans for that scenario? Keep up the good work. Just paying attention to the numbers has benefits as you have seen.